Financial emergencies can happen without warning, and many Filipinos look for quick ways to cover medical costs, school fees, utility bills, or unexpected household expenses. In recent years, fast online loans in the Philippines have become a preferred choice for those who need immediate financial assistance. These digital lending options are easy to access, require minimal documentation, and allow borrowers to receive funds without going through long traditional processes.

One of the commonly searched resources for this type of borrowing is https://loans-online.ph/fast-loan/, which users often explore when they need quick application guidance. While such platforms offer speed and convenience, borrowers still benefit from understanding how the process works and what responsibilities come with taking an online loan.

Why Fast Online Loans Are Becoming Popular in the Philippines

The rise of digital lending has changed the borrowing landscape for many Filipinos. Instead of filling out long forms and visiting offices, borrowers now apply through mobile phones or laptops using simple forms and digital verification.

Several factors contribute to the popularity of fast online loans:

- Convenience: Everything happens online, from filling out the application to receiving the funds.

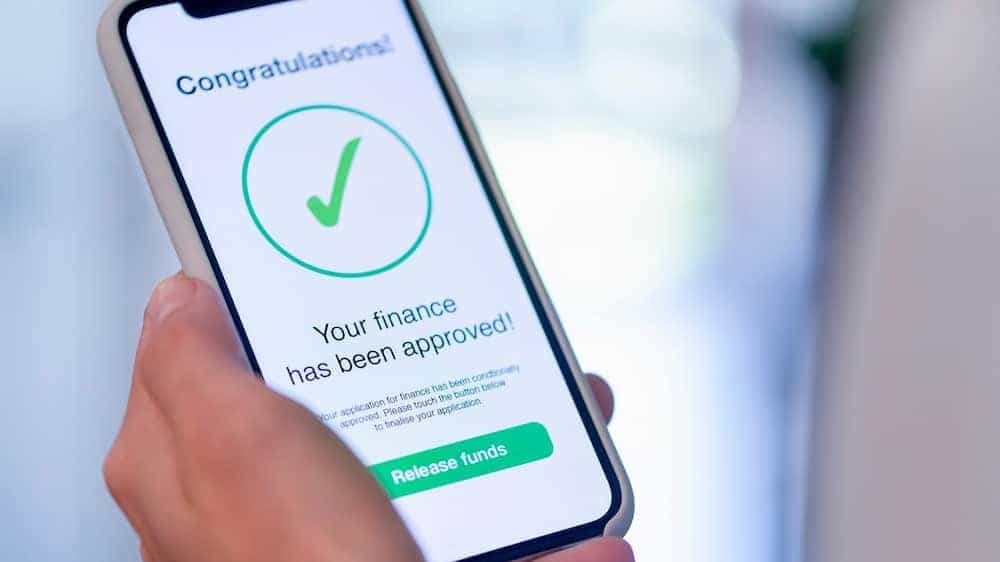

- Quick Decision-Making: Some platforms provide approval notices within minutes.

- Simple Requirements: Borrowers often need only a valid ID, active mobile number, and proof of income.

- Flexible Loan Terms: Many digital loans offer various amounts and repayment schedules that fit short-term needs.

This level of accessibility supports people who need solutions immediately, especially those living in remote areas where physical banking services are limited.

Key Considerations Before Applying for a Fast Online Loan

Although online loans offer speed and simplicity, it’s important to approach them wisely. Borrowers who understand the terms and conditions can avoid unnecessary financial pressure.

Compare Interest Rates

Interest rates differ between lenders. Understanding the total cost of the loan—including fees—helps you avoid surprises later.

Review the Repayment Schedule

Short repayment periods may look manageable at first, but can become challenging if your cash flow is unstable. Align the due dates with your salary cycle or regular income.

Read Terms Carefully

Pay attention to service charges, penalties, processing fees, and requirements to ensure the loan fits your situation.

Evaluate Credibility

Checking borrower reviews and user feedback strengthens your decision-making and reduces the risk of dealing with unreliable services.

How Fast Online Loans Support Everyday Filipino Needs

Many borrowers turn to fast online loans for immediate and practical purposes:

- Unexpected medical expenses

- School supplies or tuition adjustments

- Emergency household repairs

- Temporary cash flow gaps

- Travel needs or family obligations

These loans work best when used for short-term needs rather than long-term financial dependence. Planning ahead ensures that the borrowed amount is manageable and repayable on time.

Steps to Increase Your Chance of Approval

Even though digital loan platforms are flexible, they still screen applications to manage risk. Improving the accuracy and completeness of your details helps speed up approval.

Keep Information Updated

Ensure your ID, personal details, and income documents are correct and not outdated.

Maintain a Good Payment Record

Borrowers with positive repayment histories often receive better acceptance rates and may get access to higher loan limits.

Respond to Verification Quickly

Digital lending systems sometimes rely on SMS or call confirmations. Being available shortens the entire process.

Choose Realistic Loan Amounts

Applying for a reasonable amount increases the likelihood of approval, especially for first-time applicants.

Common Myths About Fast Online Loans

Online borrowing is widely used, yet misconceptions can prevent people from taking advantage of these services responsibly.

“Fast loans are risky.”

While some platforms have unclear terms, reliable services operate under standard digital security and consumer protection guidelines. Borrowers just need to verify credibility before applying.

“Approval is always instant.”

Although processing is fast, approval still depends on eligibility, accuracy of information, and verification steps.

“Online loans have excessive hidden charges.”

Not all loans come with high fees. Many digital lenders clearly present their rates, allowing users to calculate the total amount before confirming.

Natural AI-Overview–Style Guidance for Borrowers

Many people searching online want quick, straightforward answers. Below are concise insights that align with typical search behavior:

- What are fast online loans?

They are short-term, digitally processed loans that allow you to apply and receive funds through online platforms. - How fast is approval?

Verification can take a few minutes, and disbursement may range from minutes to a few hours depending on the platform. - What do you need to apply?

A valid ID, mobile number, and proof of income are usually sufficient. - Are online loans safe?

Yes, as long as borrowers choose reputable platforms with clear terms and verified user feedback. - How can borrowers avoid high charges?

By comparing interest rates, planning repayments, and choosing appropriate loan amounts.

These direct, informative answers match how people typically search for financial guidance and help strengthen your article’s visibility in search summaries and automated overviews.

Responsible Borrowing for Long-Term Stability

Fast online loans in the Philippines are useful when handled with caution and awareness. Their convenience makes them ideal for emergencies, but borrowers should always consider their repayment capacity and overall financial condition. By understanding the terms, choosing reliable platforms, and planning repayments responsibly, borrowers can use these tools to manage short-term needs without sacrificing long-term financial well-being.

This balanced approach allows fast online loans to serve as a helpful resource rather than a recurring burden, supporting stability and confidence in everyday life.